What is a credit union?

More than just another financial services provider!

- A Not for Profit financial co-operative

- Committed to our members

- Committed to our community

Salford Credit Union exists to provide safe, competitive and fair financial services to our members .

We aim to help you take control of your money by:

- Encouraging you to save what you can

- Only borrowing what you can afford to repay

Our Commitment to our local community and partners

Salford Credit Union has been providing services for over 30 years, when a group of volunteers first set up Mandley Park Savings & Loans.

We’re a social enterprise and help members save in at least 7 ways:

- First- all members get a Savings Account. Fully regulated and safe, and available from birth. Many members tell us they had no savings before opening their Credit Union account

- Second- we keep encouraging the Savings habit– asking members to keep saving even while paying back loans

- Third- we can often provide Loans to people who might otherwise have to use high cost lenders- whose interest rates can be ten times as high as ours. Credit Union interest rates are capped by government.

- Fourth-we help keep money in people’s pockets. We estimate we save members around £1m/year by providing our low cost loans- compared to having to use doorstep lenders

- Fifth- this helps our local economy, because people have more money to spend on local goods and services.

- Sixth- if we make enough surplus it is shared as a dividend to members

- Seventh- we work with other local partners, including Salford City Council, local housing providers and local voluntary and community organisations. We work on shared objectives, particularly in relation to Anti Poverty, financial resilience and economic prosperity so that people can enjoy a good life in Salford and the wider area.

Support from Salford City Mayor

We are very grateful for support from all our partners. Paul Dennett, Salford City Mayor has provided a short video to show his support for our work.

We’re part of a bigger movement!

Credit Unions have always been part of a large international movement since they were first set up.

- More than 200million members in 100 countries worldwide

- 2million members in the UK

All Credit Unions share the same offer:

- Mutual and Ethical Savings

- Affordable loans

- Run by you, for you

- Putting you first- serve you’ the member’ by listening to your needs and developing products and services that you want

Here in Greater Manchester Salford Credit Union are proud to be working with other local Credit Unions. We have formed the Consortium of Greater Manchester Credit Unions and have developed the Sound Pound website to help get our message out across the area.

We are working together to help Greater Manchester communities face the challenges of Covid19. Find out more here:https://soundpound.co.uk/

How to apply

Loan Application

-Loans are available to both existing Credit Union members and people hoping to join. The loan application for non-members includes a membership application, so if your loan is successful your applicationyou will automatically join and we will open a savings account for you.

EXISTING CREDIT UNION MEMBER?

NON-MEMBERS

Membership Application

– you will need your National Insurance number and bank details

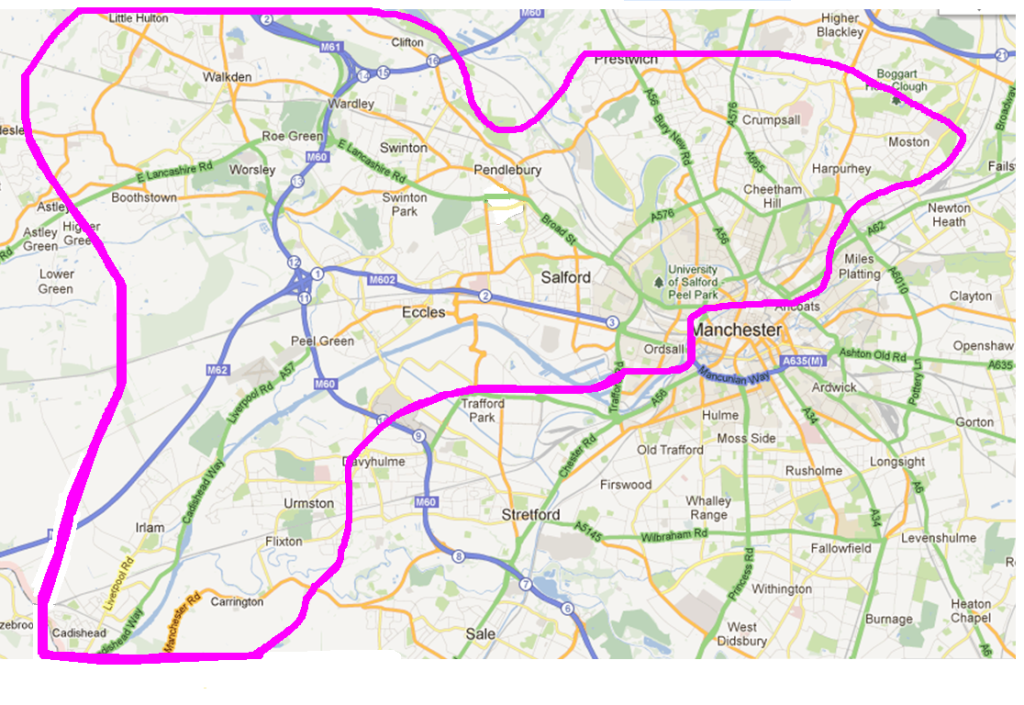

Salford Credit Union can only offer services to its members. Our membership is based on a Common Bond- a link shared by people who belong to a specific community- living or working in our area, which includes Salford and areas shown on the map below. People who are members of Unite the Union or Unison (North West region) can also apply to join.

If you are unsure as to whether or not you qualify, please contact us directly on 0161 686 5880, email us at info@salfordcreditunion.com or head over to this page to find out more.